The latest news relevant to you and your business

EEOC Releases Final Edition of Workplace Harassment Guidance for Employers

On April 29, 2024, the U.S. Equal Employment Opportunity Commission (EEOC) released the final edition of workplace harassment guidance for employers, formalizing for the first time in more than twenty-five years the EEOC’s interpretation of legal standards and employer liability under federal antidiscrimination law. This lengthy and comprehensive revision of guidance for employers details updated applications of federal law prohibiting harassment and retaliation in response to a multitude of new developments within the legal framework of discrimination as applied to the modern workforce. Key takeaways from these revisions include the recognition of unlawful harassment against LGBTQ+ individuals with particular attention given to workplace protections for sex, including pregnancy, childbirth, or related medical conditions, sexual orientation, and gender identity, in addition to race, color, religion, national origin, disability, genetic information, and age.

The EEOC’s final edition of workplace harassment guidance mirrors the 2020 legal ruling from the Supreme Court of the United States which held that gender discrimination under Title VII of the Civil Rights Act of 1964 may include claims based on sexual orientation and gender identification and identifying the potential nature of unlawful workplace harassment against LGBTQ+ individuals, including harassment from any person such as coworkers, managers, supervisors, customers, and clients.

This new guidance on unlawful sex-based discrimination under Title VII includes discrimination based on sexual orientation or gender identity and gives examples of discrimination such as epithets, physical assault, outing, or “the disclosure of an individual’s sexual orientation or gender identity without permission,” “harassing conduct because an individual does not present in a manner that would stereotypically be associated with that person’s sex, repeated and intentional use of a name or pronoun inconsistent with the individual’s known gender identity (misgendering), or the denial of access to a bathroom or other sex-segregated facility consistent the individual’s gender identity.” More information and examples as provided by the EEOC can be located here.

Other important updates to what is now recognized as workplace harassment under Title VII as well as other federal antidiscrimination laws include broadening the scope of harassment based on race and color to encompass not only race and national origin, but also color-based harassment focused on an individual’s skin pigmentation, complexion, or skin shade or tone. Harassment based on pregnancy, childbirth, or related medical conditions can now include harassment related to an individual’s lactation, abortion, or contraceptive decisions if the harassment is linked to a targeted individual’s sex. The new guidance also provides clarification on what is considered unlawful harassment under the Genetic Information Nondiscrimination Act (GINA), which includes “harassment based on an individual’s or an individual’s family member’s genetic test or on the basis of an individual’s family medical history.”

The EEOC also provides guidance on retaliatory harassment and provides a distinction between the legal standards for hostile work environment and retaliation. The anti-retaliation provisions encompass a broader range of conduct including “anything that might deter a reasonable person from engaging in protected activity.”

This new guidance from the EEOC took effect immediately upon release so it is imperative that employers review their policies and procedures soon to ensure compliance with not only these new guidelines but any applicable state and local laws that may provide additional regulations, as well.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor these new guidelines and related litigation. If you have questions, please contact your HRBP for assistance. Additional information on the EEOC new guidelines outlined above can be found at the attached link.

Minnesota Paid Family and Medical Leave Bill

The Minnesota Department of Employment and Economic Development (the “Department”) recently updated employer requirements under the Minnesota Paid Family and Medical Leave legislation that was signed into law last year. This new legislation will provide paid family and medical leave for employees in Minnesota, beginning January 1, 2026. This leave is a state administered program, overseen by the Department in which the state provides partial wage replacement as well as job protection for workers in Minnesota needing time away from their job to care for a serious medical condition, a family member’s serious medical condition, to bond with a new child, provide support for a family member who has been called to active military duty, or to seek help for themselves or a family member due to domestic violence, sexual assault, or stalking. This paid leave program will cover most Minnesota employers with one or more employees, including part-time employees in this state, with few exceptions including self-employed individuals who choose to provide coverage for themselves.

These recently published updates include employer wage detail report submission obligations that are slated to begin October 31, 2024, which will reflect wages paid between July 1, 2024 and September 30, 2024. The Department plans to release specific instructions for employers in the next couple of months, however, for employers already submitting quarterly wage detail reports within the unemployment system, no action will be required. Those employers not covered by the unemployment insurance program will to be required to begin quarterly report submissions and will need to create a “Paid Leave Only” account in order to do so. It is important for employers to note that the Paid Family and Medical Leave is a new program that is separate and distinct from the Unemployment Insurance program requirements. This new Paid Leave program does not exclude the same employers that are otherwise excluded from Unemployment Insurance guidelines.

Additionally, the Minnesota Paid Leave is different from the Minnesota Earned Sick and Safe Time program which is administered by the Minnesota Department of Labor and Industry and went into effect on January 1, 2024. As a reminder, this employer sponsored leave is sick and safe paid time off employers must provide to employees for various reasons including employee illness, for employees to care for a sick family member or for an employee or family member to seek assistance due to domestic violence, sexual assault, or stalking.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor this new law and related regulations and litigation. If you have questions, please contact your HRBP for assistance. Additional information on the distinction between the two leave programs outlined above can be found at the attached link.

The City of Chicago Finally Releases Regulations Interpreting the New Paid Leave and Paid Sick and Safe Leave Ordinance, set to become effective July 1, 2024.

On April 30, 2024, The City of Chicago Department of Business Affairs and Consumer Protection (BACP) published final regulations providing some clarity on the Chicago Paid Leave and Paid Sick and Safe Leave Ordinance requirements, which are slated to take effect on July 1, 2024. As first outlined in an Insights article last year, the original effective date for this new leave law was December 31, 2024, but was quickly delayed until July 1, 2024, due to logistical requirements surrounding the implementation and enforcement of these sweeping regulations. The new Paid Leave and Paid Sick and Safe Leave Ordinance will require Chicago employers to provide employees with up to 40 hours of paid sick leave and up to 40 hours of paid leave for any reason. Experts agree that while the final regulations help, employers may still be left with questions. An outline of the major highlights from the regulations are as follows:

The Definition of a 12-Month Benefit Year or Period

The final regulations take a less rigid approach to the requirement that “[t]he 12-month period for a covered employee shall be calculated from the date the covered employee began to accrue Paid Leave and Paid Sick Leave.” Employers are now allowed to determine a 12-month benefit period of the employer’s preference to set for an employee to receive Paid Time Off and Paid Sick Leave benefits, provided that the established 12-month timeframe consist of consecutive months such as the tax year, the calendar year, or anniversary date of employee’s employment. The employer has the option to set different dates for each covered employee or require all covered employees to have benefits awarded on the same 12-month benefit cycle date, however the integrity of the leave regulations must be maintained.

The employer also has the option to front-load, or immediately grant covered employees at least 40 hours of paid leave or 40 hours of paid sick leave or both at the beginning of employment or the established benefit cycle year. If the employer grants covered employees 40 hours or more of paid leave “no later than 90 days after the covered employee began working for the employer, the employer is not required to provide additional paid leave (until the following benefit year or cycle). If an employer grants covered employees 40 hours (or more) of paid sick leave no later than 30 days after the covered employee began working for the employer, then the employer is not required to provide additional sick leave” until the following benefit year or cycle.

Carryover Required

The regulations now require that employees be allowed to carryover up to 80 hours of accrued and unused Paid Sick Leave and up to 16 hours of accrued and unused Paid Leave from one 12-month benefits period to the next. This carryover will be in addition to the Paid Sick Leave and Paid Leave the employee will earn in the subsequent 12-month benefit year. Furthermore, as mentioned above, employers may frontload at least 40 hours of Paid Leave and at least 40 hours of Paid Sick Leave on the first day of the 12-month benefit period. This frontloading method will absolve the employer from having to carryover paid leave hours but frontloading 40 hours of paid sick leave will NOT absolve the employer’s obligation to carryover the employee’s paid sick leave requirements from one benefit year cycle to the next.

Usage and Notification

Employers shall establish reasonable, written paid leave and paid sick leave policies, which include advance notice procedures and an outline of the reasons for potential leave request denials. Such policies should be made available in English and in any language that employees are literate and may be included in an employment handbook, a manual or separate document. Covered employees shall be allowed to use accrued paid leave by the 90th calendar day following the beginning of their employment and accrued paid sick leave by the 30th calendar day following the beginning of their employment, regardless of the size of the employer or the number of employees employed by the employer. If the employer allows for a more general or generous Paid Time Off policy, the employee shall be allowed to utilize all leave by the shorter 30th calendar day timeframe, rather than the 90th calendar day.

Employers are permitted to require that employees obtain “reasonable pre-approval” from the employer before using paid leave for “purposes of maintaining continuity of the employer operations.” A list of relevant factors are provided by the BACP to help employers evaluate operational needs. Reasonable notice required from employees for use of paid leave shall not exceed seven days. All denials of paid leave must be done in writing from the employer and must state the pre-established policy reasoning for the denial and be issued to the covered employee immediately upon the denial.

Employers must post the city created Notice poster, outlining the Paid Sick Leave and Paid Leave regulations which can be done through the employer’s usual course of communication and can include electronic dissemination or paper postings. In addition, as a part of the on-boarding process or prior to the commencement of employment, all new hires should be notified in writing of the employer’s Paid Leave and Paid Sick Leave policies.

Should an employer elect to frontload leave time, written notification of the policy including available time off should be provided to the employee at the commencement of the 12-month benefit period. Written notification is also required annually with a paycheck or stub issued within 30 days of July 1, every year, alerting employees to the employer’s Paid Sick Leave and Paid Leave policies.

Other regulation clarifications included in the new guidelines pertain to any changes to the employers’ paid leave policy notification requirements. Employers are required to provide at least five calendar days’ notice before implementing any notification requirement changes. Furthermore, employers now need to provide at least 14 days’ advance written notice to employees if a policy change will affect their right to final compensation for the paid leave under the payout requirements. Employers are also required to provided notification to employees of the availability of paid leave and paid sick leave as well as the employee’s use of the leave in an updated and reasonable manner, such as regular paystubs, payroll statements, an updated on-line portal or even providing a handwritten record of available time.

This is just an overview of the clarifications provided by Chicago’s BACP on the Paid Leave and Paid Sick and Safe Leave regulations. Employers are encouraged to review the Chicago Paid Leave and Paid Sick and Safe Leave Ordinance as well as the prior Insights article for further information, including but not limited to payout requirements and how the new regulations interface with Collective Bargaining Agreements. Link to prior article?

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor this new law and related regulations and litigation. If you have questions regarding the City of Chicago’s Paid Leave and Paid Sick and Safe Leave Ordinance regulations or the required Posting, please contact your HRBP for assistance.

California Workplace Violence Prevention Act

As a follow-up to our last Insights article regarding the California Workplace Violence Prevention Act. We would like to remind you that California employers need to create and implement a Workplace Violence Prevention (WVP) Plan by July 1, 2024. The new law applies to all California employers, large and small, with the exception to the healthcare employers, who are already covered under Cal/OSHA’s existing healthcare WVP Standard.

For more information on Workplace Violence Prevention Plan, the Occupational Safety and Health Administration (OSHA) has released useful information for employers that can be found here.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding the California Workplace Violence Prevention Law requirements or updating your existing polices, please contact us.

New York City Bans Contractual Terms Shortening Period of Time to File Complaints or Civil Actions Relating to Discrimination, Harassment or Violence

Effective May 11, 2024, New York City now prohibits employers from entering into any type of agreement that shortens the statutory period by which an employee may file an administrative claim or complaint, or civil action, relating to unlawful discriminatory practices, harassment or violence under the New York City Human Rights Law, Admin. Code § 8-101, et seq. (NYCHRL).

Currently, New York City employees have one year from the date of the alleged violation to file a complaint with the NYC Commission on Human Rights for an unlawful discriminatory practice or act of discriminatory harassment or violence, and three years to file a claim of gender-based harassment. In addition, employees may initiate a civil action in court under the NYCHRL within three years of the alleged violation.

What Does the Ordinance Specifically Prohibit?

The new ordinance renders “[a]ny provision of an agreement involving an employer, employment agency, or agent thereof pertaining to terms of employment” that purports to shorten the periods in which either: (1) a complaint or claim may be filed with the NYC Human Rights Commission; or (2) a civil action may be filed in court as void and unenforceable. In other words, any provision, term, or language in an employment contract that claims to shorten an employee’s statutory time to file an administrative claim, or a civil lawsuit will now be deemed void.

When Does the Ordinance Go into Effect?

The law became effective immediately on May 11, 2024.

Does the Ordinance Apply Retroactively?

The broad language used in the ordinance indicates that it was intended to apply to all employment agreements in effect prior to its enactment.

What should employers do now?

Given that the ordinance took effect immediately, companies with employees working in New York City should take inventory of their existing employment agreements to ensure compliance. Employers should also review their handbooks and other policies. Employers should also be aware that any such provisions in existing employment agreements are no longer enforceable.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor this new law and related litigation. If you have questions, please contact your HRBP for assistance.

New Legislative Changes Impacting Maryland Employers

Modifications to Maryland’s Paid Family and Medical Leave Program: Maryland’s Paid Family and Medical Leave (PFML) program has undergone significant modifications aimed at enhancing employee benefits and aligning with federal standards. The revised law now mandates that eligible employees can take up to 12 weeks of paid leave for various qualifying reasons, including serious health conditions, caring for a family member with a serious health condition, and bonding with a new child. The program is funded through payroll contributions from both employers and employees, with the state providing detailed guidelines on the contribution rates and the administration process. Employers must ensure compliance with these changes by updating their leave policies and informing employees about their rights and responsibilities under the new law. Senate Bill 485, cross-filed with House Bill 571 and signed by the governor on April 25, 2024, updates Maryland’s Paid Family and Medical Leave Insurance (FAMLI) program, initially established by the Time to Care Act of 2022. Effective October 1, 2024, the bill alters administrative deadlines, definitions, and components of the program’s administration. It authorizes the Maryland Department of Labor (MDOL) to set fees for private employer plans.

Key changes include:

- Delayed Implementation Dates: Required contributions start July 1, 2025, and benefit payments start July 1, 2026.

- Coverage and Eligibility: Employees must have worked at least 680 hours in Maryland over the four prior calendar quarters.

- Contribution Rate: Contributions are based on wages up to the Social Security wage base, with the rate set by February 1, 2025.

- Private Employer Plans: Employers must either use a state-approved program or an authorized insurance plan and may face application and renewal fees.

- Appeal Costs: If an employee wins an appeal against a private employer plan, the MDOL may charge the employer or insurer for appeal costs.

Draft regulations were issued in January 2024, with revisions anticipated. Full implementation of the FAMLI program remains uncertain, pending final regulations and further guidance from the MDOL. Find more information here.

Implementation of Pay Transparency Requirements for Job Postings: In a move towards greater workplace equity, Maryland has enacted new pay transparency requirements for job postings. Effective on 10/1/2024, employers are required to include the salary range or wage rate in all job advertisements. This legislation aims to address pay disparities and promote fairness in the hiring process. By making salary information readily available, job seekers can make more informed decisions, and employers are encouraged to set competitive and equitable pay rates. Employers should review and update their job posting practices to ensure compliance with this new requirement, potentially reevaluating their compensation structures to maintain market competitiveness and internal equity.

Introduction of a New Pay Stub Template: Maryland employers should prepare for the rollout of a new pay stub template designed to provide employees with more comprehensive and transparent information about their earnings. The updated template now requires detailed itemization of hours worked, rates of pay, deductions, and net earnings. This change is intended to promote transparency and help employees better understand their compensation. Employers must adopt this new template for all pay stubs issued moving forward. It is crucial to update payroll systems accordingly and ensure that the human resources team is trained on the new requirements to avoid potential compliance issues. Maryland employers should prepare for a new pay stub template aimed at enhancing transparency and providing employees with detailed information about their earnings. The updated template requires itemized details of hours worked, pay rates, deductions, and net earnings. This change is designed to help employees better understand their compensation. Employers must adopt this new template for all future pay stubs, update payroll systems, and ensure the human resources team is trained on the new requirements to avoid compliance issues.

Conclusion: These legislative updates reflect Maryland’s commitment to fostering a fair and transparent work environment. Employers must stay informed and initiative-taking in implementing these changes to remain compliant and support their workforce effectively. By revising leave policies, ensuring pay transparency in job postings, and adopting the new pay stub template, employers can navigate these changes smoothly while promoting a more equitable workplace.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor these new guidelines and related litigation. If you have questions, please contact your HRBP for assistance. Additional information on the New employment legislation in Maryland new guidelines outlined above can be found at the attached link.

COMING SOON: New Benefit - Juice Card!

We are proud to introduce a new pay option COMING SOON for your employees – the Juice Card. This program will allow employees to access their paychecks using a convenient Prepaid Mastercard. Instead of mailing and manually depositing paper checks, the Prepaid Mastercard allows your employees to access their pay with an easy-to-use debit card. Employees can enroll through Juice Financial and manage their funds on the mobile app, allowing visibility of their finances.

The Juice Card will be available for enrollment beginning July 9, 2024. Employees will enroll through Juice Financial and manage payroll deductions through the PrestigePRO dashboard.

If you wish to opt-out your employees from receiving information on this benefit, please click here by 7/8/24.

Start Saving with SnoopDrive!

PrestigePERKS presents a new program: SnoopDrive! SnoopDrive helps protect your car and your wallet from unforeseen roadblocks ahead. SnoopDrive helps you own the road without breaking the bank. Save big on top-rated extended auto warranties and protection packages — all online, with no annoying calls or sales pressure. Get a personalized quote in seconds!

Register for access to your savings marketplace.

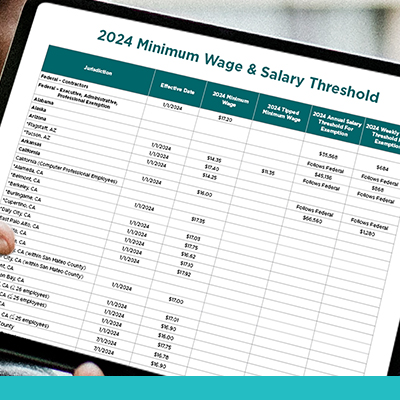

2024 Mid-Year Minimum Wage Update

PrestigePEO reminds you to review the minimum wage requirements listed by state in the button below. Some updates will take effect in the next few weeks and months and will require payroll updates if you have employees working in those places.

For quick reference:

- Los Angeles, CA will increase to $17.28/hr on 7/1/2024

- Los Angeles County, CA will increase to $17.27/hr on 7/1/2024

- St. Paul, MN will increase to $12.25/hr (>5 employees) on 7/1/2024

- St. Paul, MN will increase to $14/hr (6-100 employees) on 7/1/2024

- St. Paul, MN will increase to $15.57/hr (101-10,000 employees) on 7/1/2024

- Nevada will increase to $12/hr on 7/1/2024

- Puerto Rico will increase to $10.50/hr on 7/1/2024

- Florida will increase to $13/hr on 9/30/24

If you have any questions, please reach out to your payroll specialist.

Compensation Strategy: Tips to attract, retain, and reward talent

Compensation is one of an organization’s foundational tools used to attract, retain, and reward talent. An effective compensation strategy can benefit an organization by getting the right employees in the door, retaining these employees, and motivating them to meet the organization’s goals. Do you want to lead the market by paying your employees higher than the role generally commands or within your industry? Do you want to pay employees less than market, or do you want to target the market so your employee’s pay is aligned with others who perform the same work? The reasons for adopting one strategy over another will vary by organization. Compensation strategy that lags, meets, or leads the market will also impact employee actions.

Choosing to lead the market is great for organizations that work in highly competitive industries and need to attract top talent for their openings. In this strategy, the organization pays employees higher than the market rate. This helps to attract high quality talent and keeps strong performers in place, so employees aren’t leaving for higher pay.

Meeting the market is a good practice where an organization aligns employee pay with market rates. Many organizations target the market to attract strong talent. In general, employees earning market rates feel valued and motivated to meet the demands of their role and organizational goals. This also aids in internal equity as pay is aligned with the market and consistent throughout the organization.

Lagging the market can be a tricky strategy to use as employees may not feel that pay is equitable. Employers using this compensation strategy pay employees below market rates. Employers using this approach often find themselves constrained by limited financial resources or are prioritizing their budget toward research and development or other corporate initiatives. It is important when adopting a lag strategy to offer other benefits that attract and retain employees, such as flexibility, a great work environment, rewarding work, more paid time off, richer benefits, etc. A lagging strategy is truly a balancing act between pay and other benefits.

No matter which pay strategy you choose as an organization, you will want to ensure pay equity. Pay equity is attained by paying employees fairly across the organization based on the job responsibilities, employee experience, and the organization’s pay strategy. Having open dialogue with employees will help them to understand how they are paid. These conversations provide employers with an opportunity to share pay strategy, design, and the underlying reason for determining the employee’s pay. This helps to build trust and understanding within the organization.

In addition, some states have pay transparency laws in place mandating employers to include salary ranges on a job posting and share salary range data with employees when asked. We see this trend growing throughout the US. You can also conduct annual salary reviews to ensure pay is equitable and make adjustments when needed. While compensation strategy can be complicated, your HR Business Partner can help. PrestigePEO can help you conduct salary audits, provide compensation market data, and help support compensation reviews. Contact your HR Business Partner to get started.

AUTHOR

Rhonda Wheelous

Director of Client Services, Southeast Region

PrestigePEO

Hackensack Meridan Health Contract Negotiation

PrestigePEO wants to bring to your attention that we have received notification that Aetna and Hackensack Meridian Health (HMH) Hospitals are currently in dispute, resulting in the possible expiration of their contract effective 7/1/24.

Both sides are at the bargaining table, and Aetna is typically successful in resolving contract issues with physicians and hospitals. However, there are some instances where unreasonable requests are made and cannot be accommodated.

When this happens, contracts with hospitals and physician groups may terminate.

Some important points about Hackensack Meridian Health:

- HMH Hospitals Corporation is contractually obligated to abide by a 4-month “cooling off” period for Fully Insured Commercial members only and only for the Acute Care Hospitals. As a result, the hospitals only will remain in network through October 29, 2024.

- Members will receive communications from Aetna with updates.

- Aetna will contact all physicians who solely admit to Hackensack Meridian Health and encourage them to obtain admitting privileges at neighboring hospitals so that they can remain participating in Aetna’s network.

PrestigePEO will provide updates as we receive them.

Timely Workers’ Compensation Incident Reporting

PrestigePEO would like to remind our clients of their responsibility regarding Workers’ Compensation (WC) incidents. WC incidents must be reported within 24 hours of discovering that they have occurred. Claims that are reported more than a week late, on average, cost 10% more than timely claims. Late claims are also far more likely to end up in litigation. Prompt reporting protects the employee, your company, and PrestigePEO.

Reasons to timely report include:

- Provides the employee with immediate medical treatment and follow-up care.

- It enables our insurance company to investigate the circumstances of the incident while the facts are still fresh in the minds of the employee and any witnesses.

- Identifies potential workplace hazards.

- Avoids penalties for late claims reporting. States ($100/day) and PrestigePEO ($500 one-time fee) impose fees on delayed claims reporting.

Please help us keep our rates low and report incidents within 24 hours. Please email any incidents to WC@prestigepeo.com within 24 hours.

Feedback

If you have an idea for a future newsletter, we’d love to hear from you! Additionally, if you’d like more information on our services or programs, we can certainly accommodate that as well. Email marketingteam@prestigepeo.com today!